- SALES : (866) 707-7664

- PAYMENTS : (866) 902-7955

- 11646 PRAIRIE AVE, HAWTHORNE, CA 90250

- MON - SAT 8AM - 8PM | SUN 10AM - 6PM

- SALES : (866) 707-7664

- PAYMENTS : (866) 902-7955

- 11646 PRAIRIE AVE, HAWTHORNE, CA 90250

- MON - SAT 8AM - 8PM | SUN 10AM - 6PM

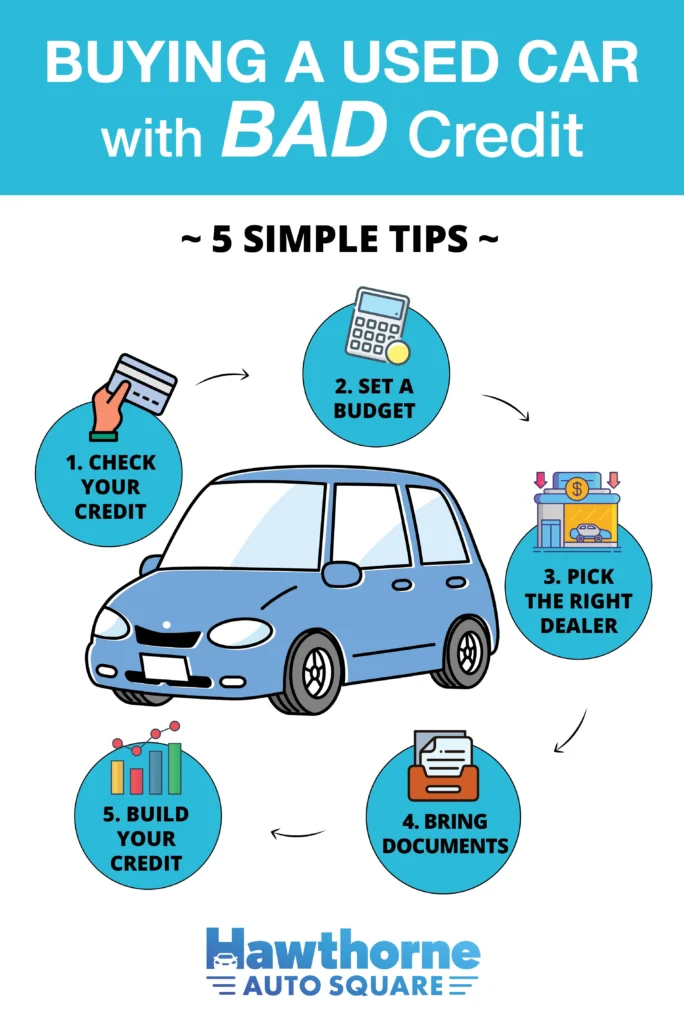

Top 5 Tips for Buying a Used Car With Bad Credit

Quick Recap

- You can buy a used car, even if you have bad credit or no credit.

- The team at Hawthorne Auto Square offers easy financing for buyers from all income levels and backgrounds.

- Set a realistic budget, choose the right dealership, and be ready to rebuild your credit when buying a used car with bad credit.

Can I Really Buy a Car with Bad Credit?

Whether you live in the city of Compton, Los Angeles, or another part of Southern California, you might think it’s impossible to buy a used car with bad credit. However, buying a used car is easier than you realize, even if your credit isn’t perfect. Hawthorne Auto Square has some tips to help you get approved to buy the used car you’ve been waiting for, regardless of your credit score or financial background.

Tip #1 – Know Your Credit Situation Before Shopping

One of the most important tips for buying a car with bad credit is to become familiar with your credit situation before you start shopping. Check your credit report (it’s free online) to see where you stand, and notify the credit bureaus if you find any mistakes or inconsistencies so they can correct them before you apply. Lenders look at your credit score and past credit history to evaluate risk, which could determine your car loan’s interest rate and how much you’ll pay at the end of the day. If you have bad credit, don’t panic, because it isn’t the end of the road when it comes to buying a used car.

Tip #2 – Set a Realistic Budget (Including Down Payment & Monthly Payments)

You’ll need to set a realistic budget when applying for used car financing with bad credit. Here’s how you can plan and set a budget that works for your lifestyle and your monthly expenses:

- Don’t just focus on the sticker price: Factor in interest rates, maintenance, and monthly loan payments for a full cost picture.

- Include other costs: Budget for insurance, taxes, upkeep, and routine maintenance.

- Consider vehicles with a low cost of ownership: Choose reliable models with low maintenance needs and easy DIY service to save money.

Tip #3 – Choose the Right Dealership That Specializes in Bad Credit Financing

When shopping for used cars, choose buy here, pay here dealerships near you that specialize in bad credit financing.

What is a buy here, pay here dealership?

A buy here, pay here dealership is a car dealership that offers financing directly to the buyer. Instead of relying on a third party like a bank or credit union, you’ll apply for your car loan with the dealership directly. This cuts out the middleman, making the approval process much smoother and faster.

Benefits of working with in-house financing dealers

There are several benefits when you apply for a car loan with bad credit with an in-house financing dealership. For one, your chances of being approved are much higher, since they don’t need you to have perfect credit or a high credit score to obtain a loan. You may also be able to purchase used cars with a low down payment or no down payment whatsoever.

How Hawthorne Auto Square helps credit-challenged buyers

Hawthorne Auto Square is the easiest car dealership to get financing with bad credit, thanks to our quick and easy buying process that helps credit-challenged buyers get the vehicle they need. We also have an extensive selection of used vehicles, including sedans, trucks, electric vehicles, and more. With lower upfront costs and lower down payment requirements, we’ll help you rebuild your credit as you pay down your new-to-you vehicle.

Tip #4 – Bring the Right Documents To Speed Up the Approval Process

The easiest and best way to get a car loan with poor credit is to bring the appropriate documents to speed up the approval process. Here are some commonly required documents you’ll need to bring when you apply:

- Government-issued ID: This may include your driver’s license, a foreign passport, a government-issued ID card, your social security card, or another form of government-issued identification.

- Proof of income: Bring some recent pay stubs, proof of self-employment (such as prior tax returns or recent paid invoices), proof of SSI benefits, or another form of proof of income.

- Proof of residence: You may submit your current lease, home title or deed, or a utility bill as proof of residence.

- Insurance info: To drive off with your used vehicle, you’ll need to purchase car insurance or prove your ability to buy car insurance.

- Trade-in documentation: If you’re trading in your current vehicle to use for a down payment, bring your trade-in documentation to include the year, make, and model, as well as the vehicle’s mileage and VIN (Vehicle Identification Number).

Tip #5 – Be Prepared To Build or Rebuild Your Credit

One benefit of used car loans for people with bad credit is that they can help you build or rebuild your credit for the future. Even if your credit score is below 500 or you have filed for bankruptcy, getting a used car loan will help you turn things around. These tips will help you build or rebuild your credit faster:

- Making car loan payments on time each month can boost your credit score.

- Ask if the dealer reports to credit bureaus, as this can help improve your score over time.

- Consider refinancing later for better rates once your credit improves to lower monthly payments.

Bonus Tip – Avoid Common Pitfalls When Buying a Car with Bad Credit

It’s also important to avoid some common pitfalls when you’re buying a car with bad credit, like:

- Watch out for high-interest scams: Some dealers may promise a low rate, then claim it’s higher after approval to lock in the sale.

- Don’t apply for too many loans at once: Multiple applications can lower your credit score and hurt approval chances.

- Know what “no credit check” means: Lenders skip a hard credit pull but review your income, job history, and other factors.

Our Service Area in Southern California

We proudly serve car buyers across Los Angeles County, Riverside County, and San Bernardino County, including:

- Zip Codes: 90044, 90047, 90003, 90002, 90250, 90260, 90301, 90303, 90305, 90262, 92503, 92505, 92404, 92407, and 92410

- Cities Served: Hawthorne, Inglewood, South LA, Compton, Gardena, Long Beach, Riverside, San Bernardino, City of Moreno Valley, and East LA

Contact Hawthorne Auto Square Today!

Hawthorne Auto Square is the trusted local authority for in-house financing, buy here, pay here programs, and affordable used vehicles. If you have bad credit and live in Southern California, you can still purchase a used vehicle when you visit our dealership. To apply for a used car or to check out our current inventory, visit one of our locations or contact us today!

Latest News

Can I Get a Car for $500 Down?

EV Owners Struggle with Tesla Charging in Cold Weather

What Is GAP Insurance and Do You Actually Need It?

Get approved

It only takes a few minutes and won’t affect your credit.

- Pre-Inspected Cars

- Clean Title

- Under Warranty

Latest Videos

What Do I Need To Buy A Car - Hawthorne Auto Square

Second Chance for a New Car - Hawthorne Auto Square

Pre Approved Auto Lone – Hawthorne Auto Square

- SALES : (866) 707-7664

- PAYMENTS : (866) 902-7955

- 11646 PRAIRIE AVE, HAWTHORNE, CA 90250

- MON - SAT 8AM - 8PM | SUN 10AM - 6PM

© 2026 Hawthorne Auto Square. All Rights Reserved. Website Designed by: Ad Leverage | Privacy Policy | Terms of Service | Manage Cookies | DSAR |License #91864

© 2026 Hawthorne Auto Square. All Rights Reserved. Website Designed by:

Ad Leverage | Privacy Policy | Terms of Service

License #91864